Trade Expectancy

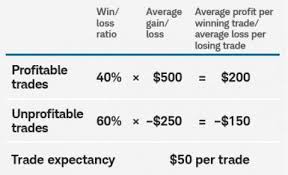

Trade expectancy is the calculation that shows what the typical profit is for each trade that is placed. If it's a negative, the strategy is a loser. Here is an easy way to understand it with a simple example.

Firstly, the calculation combines how many trades are typically won with the average loss on losers and the average gain on winners.

Say for example, you buy a stock at Rs.100, your stop loss/risk for the trade is 10 points (you will sell when the price falls to Rs. 90) and your target is 20 points from you purchase price ( i.e, Rs. 120).

Purchase price = Rs. 100

SL (stop loss) =10 points = R (risk per trade) = Rs. 90

(target level 1) = 10 points = R (reward per trade) = Rs. 110

TGT 2 (target level 2) = 20 points = 2R (expected twice the reward per trade) = Rs. 120

CASE 1 -- 50% probability of winning

= 0.5*2 - 0.5*1

= 0.5 > 0

Strategy is a winner

CASE 2 -- 60% probability of winning

= 0.6*2 - 0.4*1

= 0.8 > 0

Strategy is winner

CASE 3 -- 30% probability of winning

= 0.3*2 -0.7*1

= -0.1 <0

Strategy is a loser

CASE 4 -- Reduce the winning rate but increase the winning amount -- 20% probability of winning

= 0.2*5 - 0.6*1

= 0.4 > 0

Strategy is a winner

Many people are obsessed with the win rate in the SM. They feel that the higher number of trades going right means they can own more money in the market. On the contrary, it is possible to earn very good money even with a low win rate by simply increasing the winning amount.

What matters in the end is how much you make when the trade is right and how much you lose when the trade is wrong.

Comments

Post a Comment